IRS 14414 2012-2026 free printable template

Show details

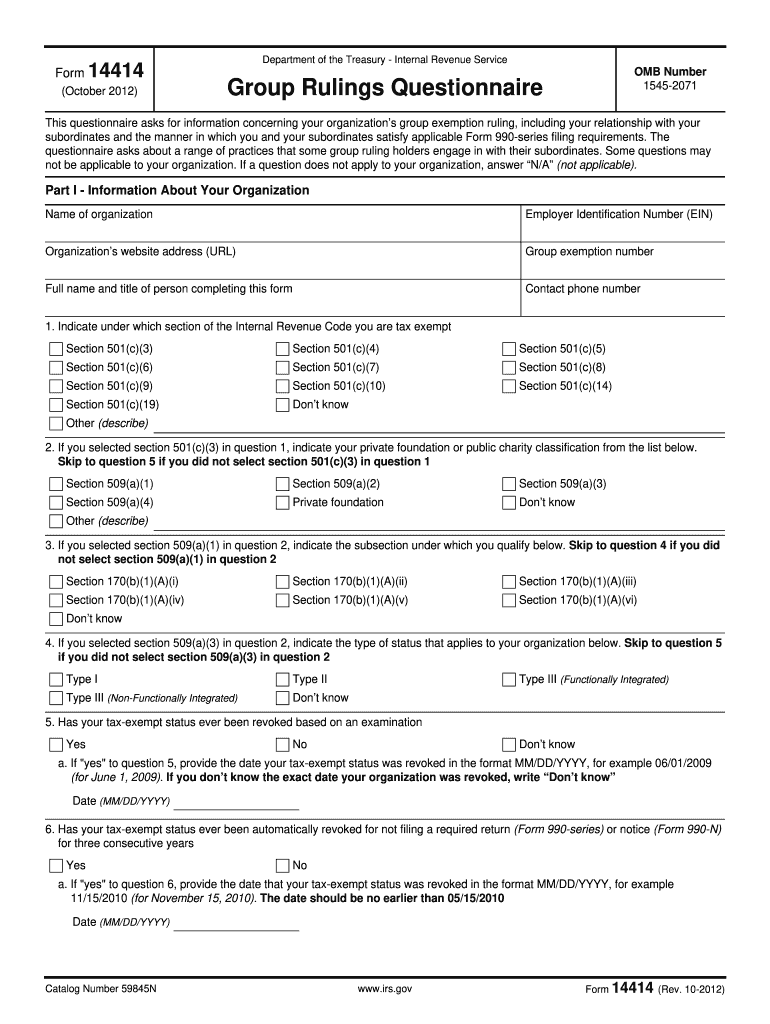

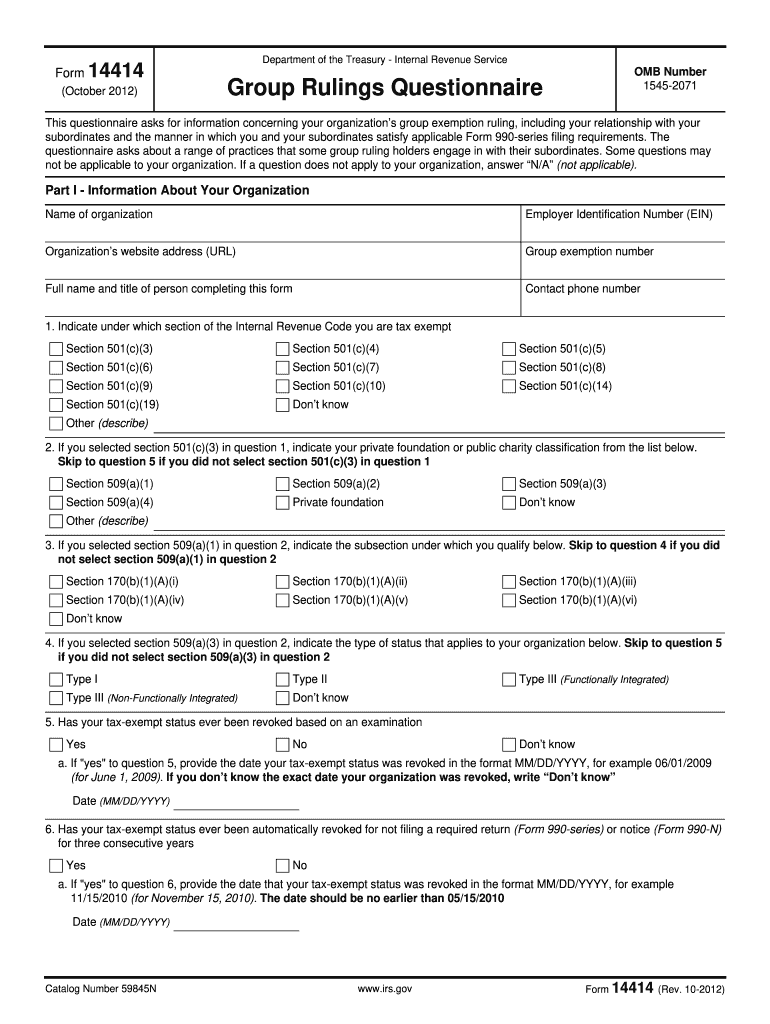

Form 14414 Department of the Treasury Internal Revenue Service (October 2012) Group Rulings Questionnaire OMB Number 1545-2071 This questionnaire asks for information concerning your organization's

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign guidance tax form

Edit your aig life form printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form irs tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

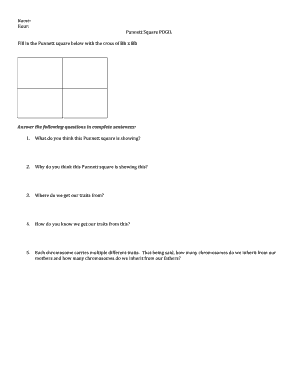

How to edit preparticipation physical evaluation form online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit aig site pdffiller com site blog pdffiller com form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out IRS 14414

How to fill out IRS 14414

01

Begin by downloading the IRS Form 14414 from the IRS website.

02

Enter your name in the designated field at the top of the form.

03

Provide your Social Security Number or Individual Taxpayer Identification Number.

04

Complete the 'Taxpayer Information' section, including your address and contact information.

05

Specify the tax return year for which the form is being submitted.

06

Fill out any additional information required in the specific sections provided.

07

Review the form for accuracy and completeness.

08

Sign and date the form before submission.

Who needs IRS 14414?

01

Individuals who are submitting Form 14414 typically include those who are applying for an acceptance agent or require a PTIN (Preparer Tax Identification Number) for tax preparation services.

Fill

form

: Try Risk Free

People Also Ask about

What does the W-2 form tell you?

A W-2 tax form shows important information about the income you've earned from your employer, amount of taxes withheld from your paycheck, benefits provided and other information for the year.

What is the difference between IT 203 and IT-201?

The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203. However, if you both choose to file a joint New York State return, use Form IT-201; both spouses' income will be taxed as full-year residents of New York State.

Is a 1040 the same as a W-2?

"No, 1040 is not the same as a W-2. W-2 is a form provided by the employer to the employee that states the gross wages in a given year and all the tax withheld and deductions," says Armine Alajian, CPA and founder of the Alajian Group, a company providing accounting services and business management for startups.

Who is required to use Form 1040?

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least:singleunder 65$12,950single65 or older$14,700head of householdunder 65$19,400head of household65 or older$21,1506 more rows

What's the difference between a w2 and 1040?

A W-2 is the form that your employer will send to you with information on your income and tax rate, while a 1040 form is the form that you fill out and send to the IRS when filing your taxes. The W-2 will have the majority of the information you need in order to file your 1040 tax form.

What is a 1040 form used for?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Fill out your IRS 14414 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 14414 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.