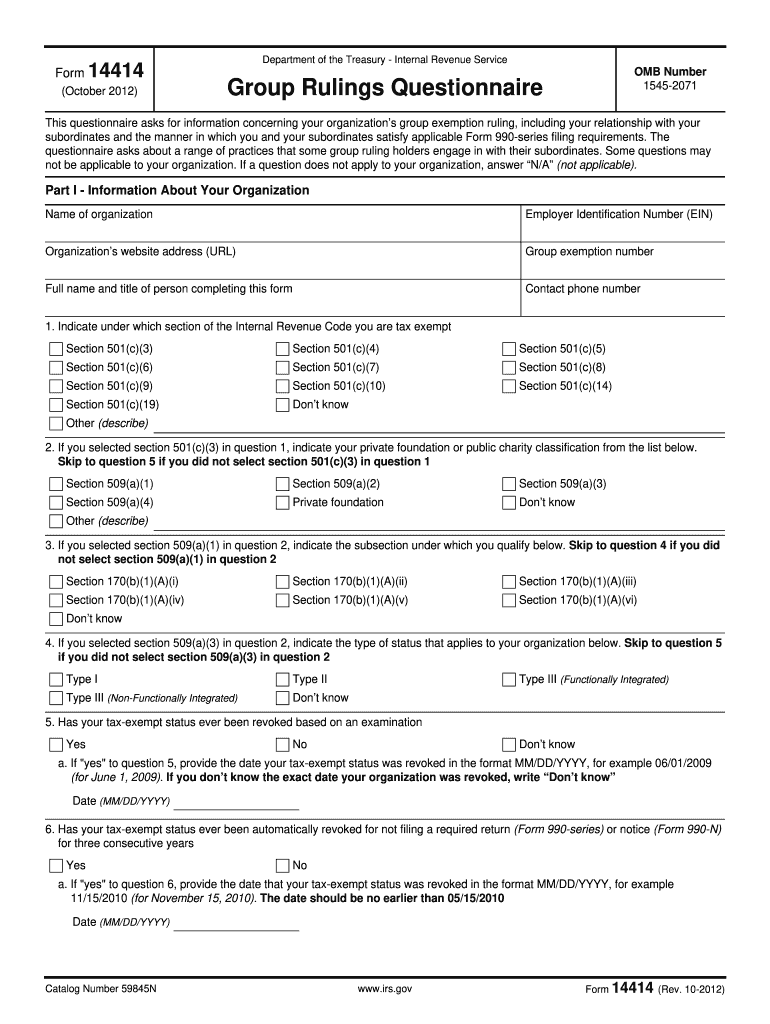

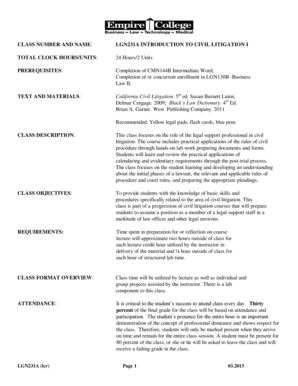

IRS 14414 2012-2025 free printable template

Get, Create, Make and Sign irs fiscal form

How to edit form irs tax online

How to fill out revenue tax form

How to fill out IRS 14414

Who needs IRS 14414?

Video instructions and help with filling out and completing 990 irs

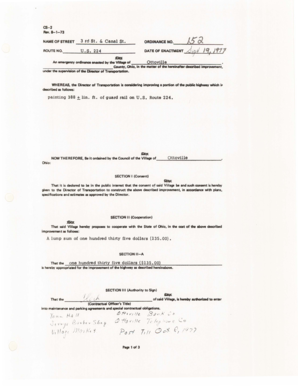

Instructions and Help about rev proc 80 27

Um pension credit is a tax-free means-tested benefit aimed at retired people on low incomes and can be worth thousands of pounds a year plus if you claim it you can access a whole raft of other benefits including council tax discounts and free TV licenses for over 75s however around 850 000 eligible households don't often claim because they don't know they can or that they need to if you're overstated pension age on a low income and live in the UK you could be getting an extra 60 pounds a week in pension credit meaning that pension credit can be worth 3 000 pounds a year on average because if you're over state pension age live in the UK and earn less than 182 pounds and 60 pence a week as a single person or 278 pounds and 70 pence a week as a couple then the main element of pension credit tops up your income to those amounts pension credit is also a gateway to free TV licenses and much more those who claim the main part of pension credit can get discounts on other bills such as council tax reduction which is worth about a thousand...

People Also Ask about 990 irs tax

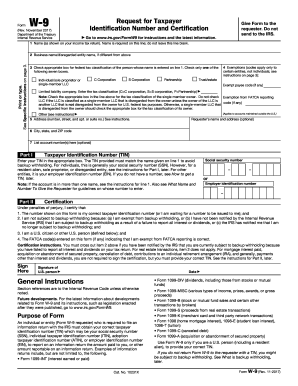

What does the W-2 form tell you?

What is the difference between IT 203 and IT-201?

Is a 1040 the same as a W-2?

Who is required to use Form 1040?

What's the difference between a w2 and 1040?

What is a 1040 form used for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send internal irs tax for eSignature?

How do I execute form internal revenue online?

How can I fill out form 990 irs on an iOS device?

What is IRS 14414?

Who is required to file IRS 14414?

How to fill out IRS 14414?

What is the purpose of IRS 14414?

What information must be reported on IRS 14414?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.